You'll report your self-employment income (or loss) on Schedule C or Form 1040 from any business you operated as a sole proprietor in which you ran for profit.

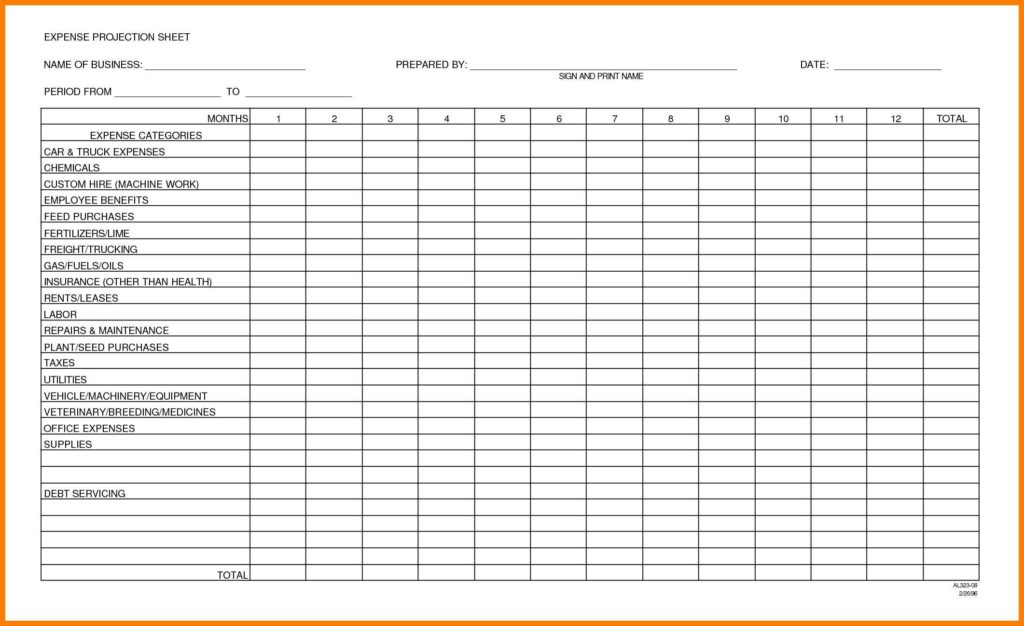

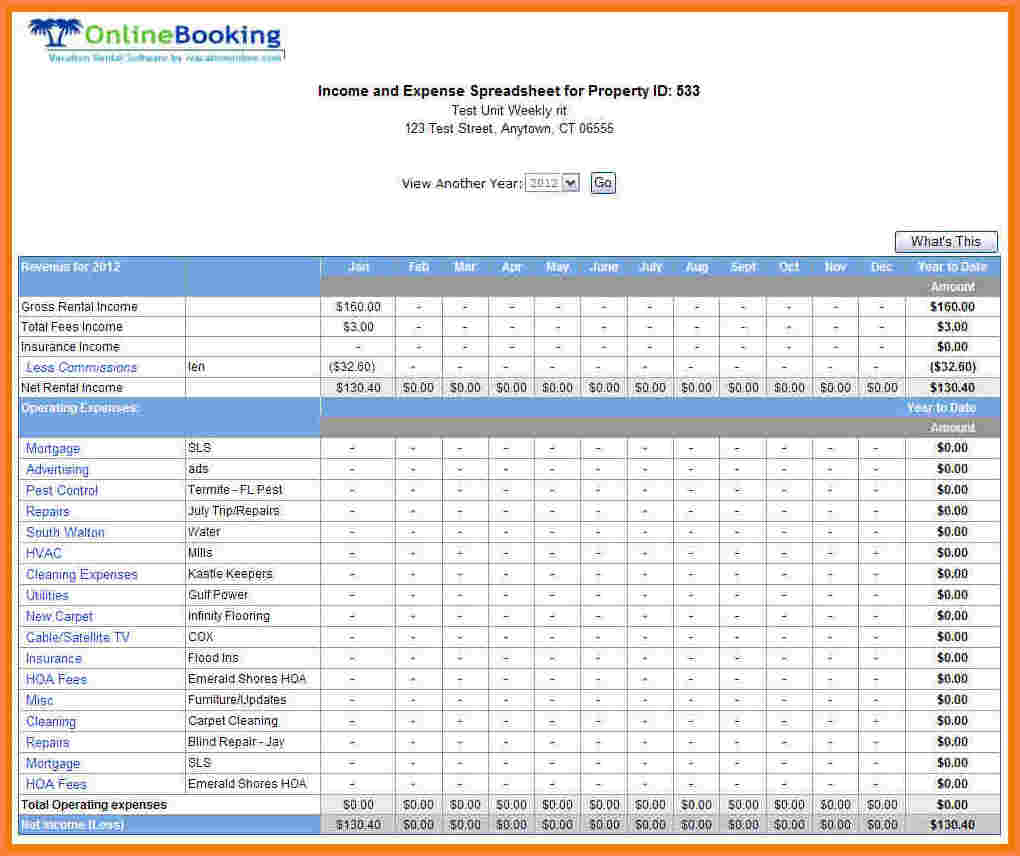

You must properly record your expenses and income from self-employment in order to pay taxes on your earnings at the end of the year. You'll write down the provider (if it’s an expense).ĭownload Our Self-Employment Ledger Template For Free Service/product: how you earned the income and who the client is if it’s an invoice).Category expense: the business deductible type for the expense.Reason: the intent for why you made the purchase.Amount: how much you received or paid for the expense or invoice.Date: when the expense or payment was received.You'll fill out the self-employment ledger documentation form with all the necessary financial records and bookkeeping information for your taxes. What To Track With A Self-Employment Ledger We'll take the headache away from tracking your self-employed income and expenses as well as make running your business a lot easier. In other words, Bonsai is a sole proprietors dream. Note: If you want to manage invoices, contracts, business expenses, calculate your taxes, and create a business bank account instantly, try Bonsai. First, download our free self-employment ledger template below. In this article, we'll give you a free template and show you how to do proper self-employment ledger documentation. The most important thing a self-employment ledger does is keep accurate and up-to-date records of your income for your taxes.

Pretty much anything that you can use to record all self-employment income and expenses.

A self-employment ledger can be kept online via a spreadsheet, a document from an accounting software program, or even on a handwritten records book or spreadheet. A self-employment ledger form is an accurate, detailed record or document of your self-employment income and expenses.

0 kommentar(er)

0 kommentar(er)